Project Background

- This contract leverages a combination of decentralized oracles, governance control, and access control mechanisms to maintain and adjust the collateralization and supply of the FRAX stablecoin dynamically. The design ensures that only authorized entities can mint and burn FRAX, and that the system parameters can be adjusted in a controlled manner to respond to market conditions.

- The provided Solidity code defines a smart contract named `FRAXStablecoin`, which extends the `ERC20Custom` and `AccessControl` contracts. This contract is designed for the FRAX stablecoin system, incorporating features such as dynamic collateral ratio adjustment, minting, and burning of tokens, and integration with Chainlink and Uniswap oracles for price feeds.

- The token is without any other custom functionality and without any ownership control, which makes it truly decentralized.

- Overall, this contract implements a stablecoin with dynamic collateralization ratio adjustments based on the price of FRAX. It also provides functionalities for interacting with pools and managing parameters like fees, oracles, and permissions.

Website: frax.finance

Executive Audit Summary

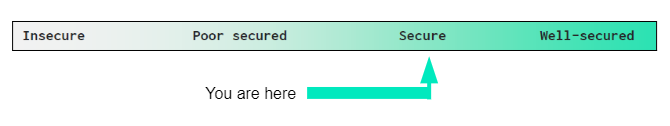

- According to the standard audit assessment, the Customer`s solidity smart contracts are “Secured”. Also, these contracts contain owner control, which does not make them fully decentralized.

- We used various tools like Slither, Solhint and Remix IDE. At the same time this finding is based on critical analysis of the manual audit.

- We found 0 critical, 0 high, 0 medium, 1 low and 3 very low-level issues.

Audit Report in PDF

Audit Report Flip book

Please wait while flipbook is loading. For more related info, FAQs and issues please refer to DearFlip WordPress Flipbook Plugin Help documentation.